In Vietnam, thousands of impact-driven SMEs are striving to solve some of our most urgent challenges — from clean water and sustainable agriculture to climate resilience and food security. Yet too often, these enterprises face financing gaps that keep their ideas from scaling.

EcoChain was born from a shared belief: that finance should do more than sustain businesses — it should help them change the world. Together, Impact Link Asia— a specialist in social impact consulting—and Micro Fund JSC, a fintech pioneer in SME financing, have joined forces to turn that vision into reality.

🌟What makes EcoChain different?

By linking access to capital with measurable social and environmental outcomes, EcoChain ensures that financial growth and positive impact go hand in hand. Our dual-scoring system empowers SMEs to showcase both their creditworthiness and their contributions to people and planet — making it easier for funders and banks to back enterprises they can trust.

🌟Who benefits?

🌸 SMEs gain the financial space to grow and innovate.

🌸 Funders & Banks unlock efficient, lower-cost ways to support credible impact-ready businesses.

🌸 Communities & the Environment benefit from scalable solutions to Vietnam’s most pressing needs.

🌍 Starting with high-impact sectors — WASH, Sustainable Agriculture, Environment, and Food Manufacturing — EcoChain is helping accelerate Vietnam’s journey toward the UN Sustainable Development Goals (SDGs).

This is more than a platform. It’s a movement to reimagine finance as a driver of profit with purpose!

👉 Learn more and join us: https://lnkd.in/gaFsmQqt

✨ EcoChain — Financing that powers impact!

Introducing EcoChain: Financing that powers impact!

Read more

Introducing EcoChain: Financing that powers impact!

18.11.2025

What is Social Impact Consulting?

13.03.2025

Nurturing an Ecosystem for Youth Development: How Dear Our Community Leverages Partnerships

25.02.2025

Top Emerging Trends in Social Impact: Watchlist Must-Haves

24.02.2025

Impact Measurement and Management (IMM) 2025 Trends

03.02.2025

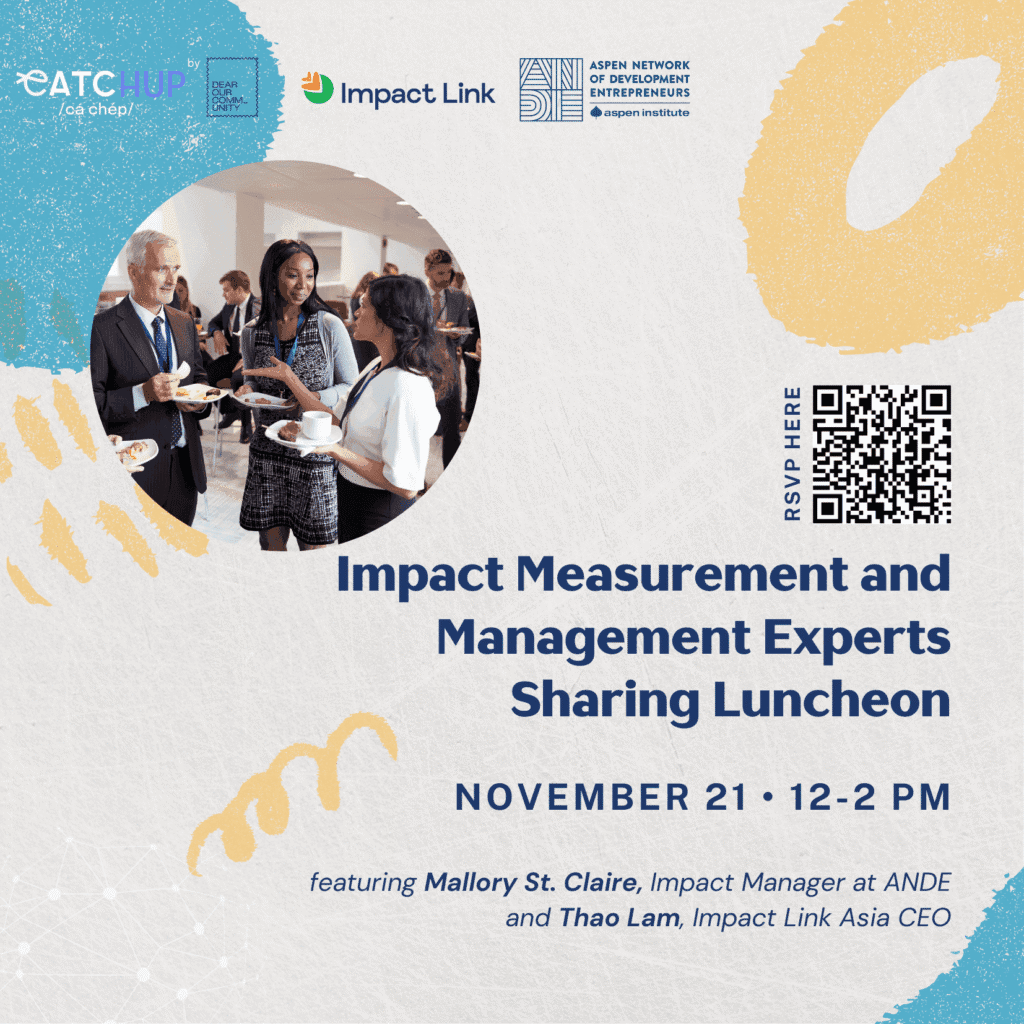

Impact Measurement & Management (IMM) Experts Sharing Luncheon

12.11.2024

Impact Business Lab (IBL) Final Showcase 2024 at Fulbright University Vietnam

03.11.2024

Championing Cultural Diversity: How Tropical Trekking is optimizing their growth strategy with

26.10.2024

Rescue, Realign, Restructure: How the MCA Toolkit Helped WagWel Rescue Strengthen Its

08.10.2024