Why Impact SMEs Struggle to Get Funding?

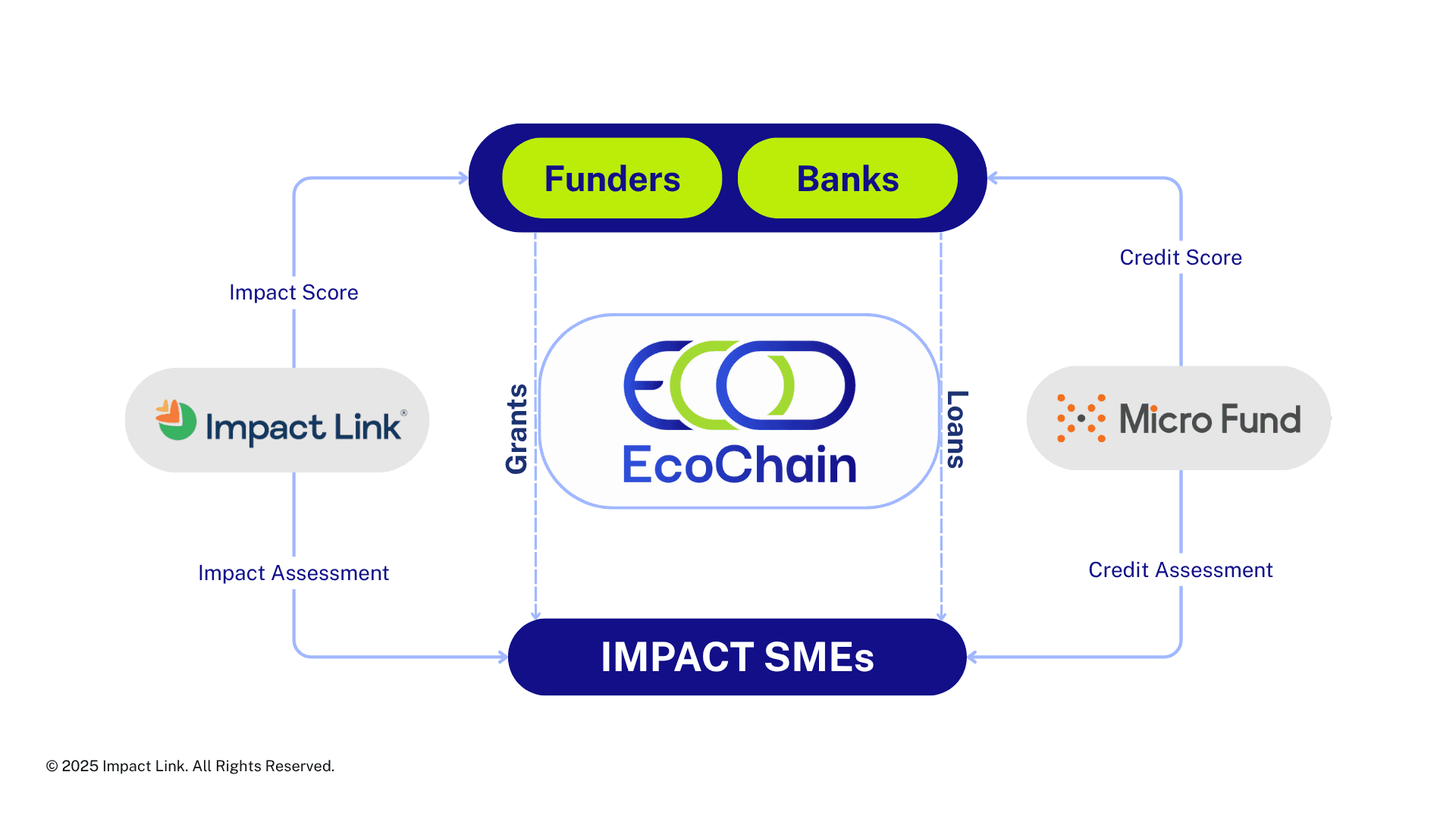

EcoChain was created to support these businesses in closing these gaps by navigating the impact-linked finance model.

EcoChain translates this principle into a scalable financing platform for Vietnam. By combining impact scoring with credit scoring, EcoChain gives funders, banks, and other financial partners a structured and reliable way to direct capital toward SMEs that deliver both economic returns and measurable social/environmental value.

01.

Mismatch between investor expectations and SME realities

02.

Ticket size gap

03.

Limited collateral or credit history

04.

Perceived higher risk

05.

Capacity constaints

06.

Lack of tailored financial products

EcoChain Works

for Funders & Banks

EcoChain simplifies the deployment of resources and reduces risks for financial partners:

01.

Dual Scoring System

SMEs are evaluated through standardized impact and credit scores, offering a clear view of both solvency and impact potential.

02.

Smart Matching

Based on these scores, EcoChain connects SMEs with funders now and prepares them for partnerships with banks in the near future.

03.

Efficient Due Diligence

Customized assessments reduce evaluation costs and align with international impact standards, giving funders measurable proof of success and banks a ready-made foundation for future products.

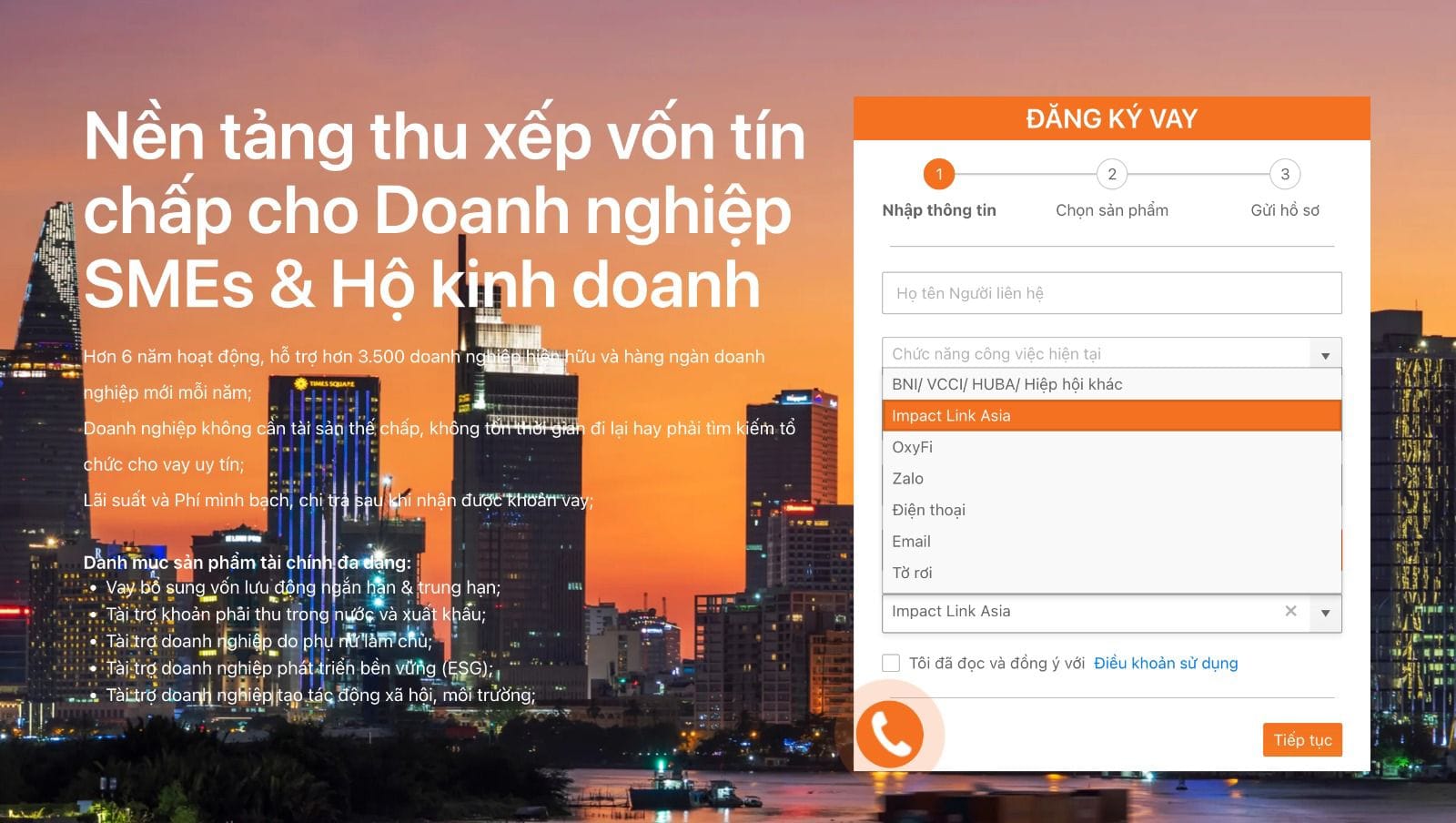

Application Process

*** Step 01:

The enterprise completes this INFORMATION FORM. This helps EcoChain gain a preliminary understanding of the enterprise’s financing needs and assess your eligibility for the program.

*** Step 02:

Follow the instructions the information from to complete the second step on Micro Fund.

Once both steps are completed and the system successfully records the application on MicroFund, EcoChain will notify the enterprise via the email provided.

Through the information gathered from the Initial Screening Round and the In-depth Interview Round, Impact Link and MicroFund will assess each SME’s impact score and credit score, thereby evaluating their creditworthiness, the positive social or environmental impact they create, and further determining their alignment with the criteria of banks and funders.

Once assessed, your application is sent to the Bank or Funder.

- They review your scores and the information provided.

- If you meet their requirements, you get approval to proceed.

The Bank or Funder decides the loan or grant terms.

- If your impact score is high, you receive preferred interest rates or possibly a grant.

- If your score is lower, you may still get funding, but at standard rates.

Who Should Apply?

EcoChain is designed for impact-driven SMEs in Vietnam.

Funders, banks - partner with EcoChain to de-risk SME finance in Vietnam.

Funders can catalyze early-stage impact, while banks gain a proven pipeline of credit-ready, high-impact enterprises!

JOIN OUR MISSION