FINANCING THAT POWERS IMPACT

A revolutionary financing initiative designed to support the heroes of Vietnam’s economy: impact-driven small and medium-sized enterprises (SMEs).

Why Impact SMEs Struggle to Get Funding?

- Mismatch between investor expectations and SME realities

- Ticket size gap

- Limited collateral or credit history

- Perceived higher risk

- Capacity constaints

- Lack of tailored financial products

EcoChain was created to support these businesses in closing these gaps by navigating the impact-linked finance model (Reference: Roots of Impact). EcoChain translates this principle into a scalable financing platform for Vietnam. By combining impact scoring with credit scoring, EcoChain gives funders, banks, and other financial partners a structured and reliable way to direct capital toward SMEs that deliver both economic returns and measurable social/environmental value.

How EcoChain Works for Funders and Banks

EcoChain simplifies the deployment of resources and reduces risks for financial partners:

Dual Scoring System

Dual Scoring System

Smart Matching

Smart Matching

Efficient Due Diligence

Efficient Due Diligence

Application Process

Initial screening round:

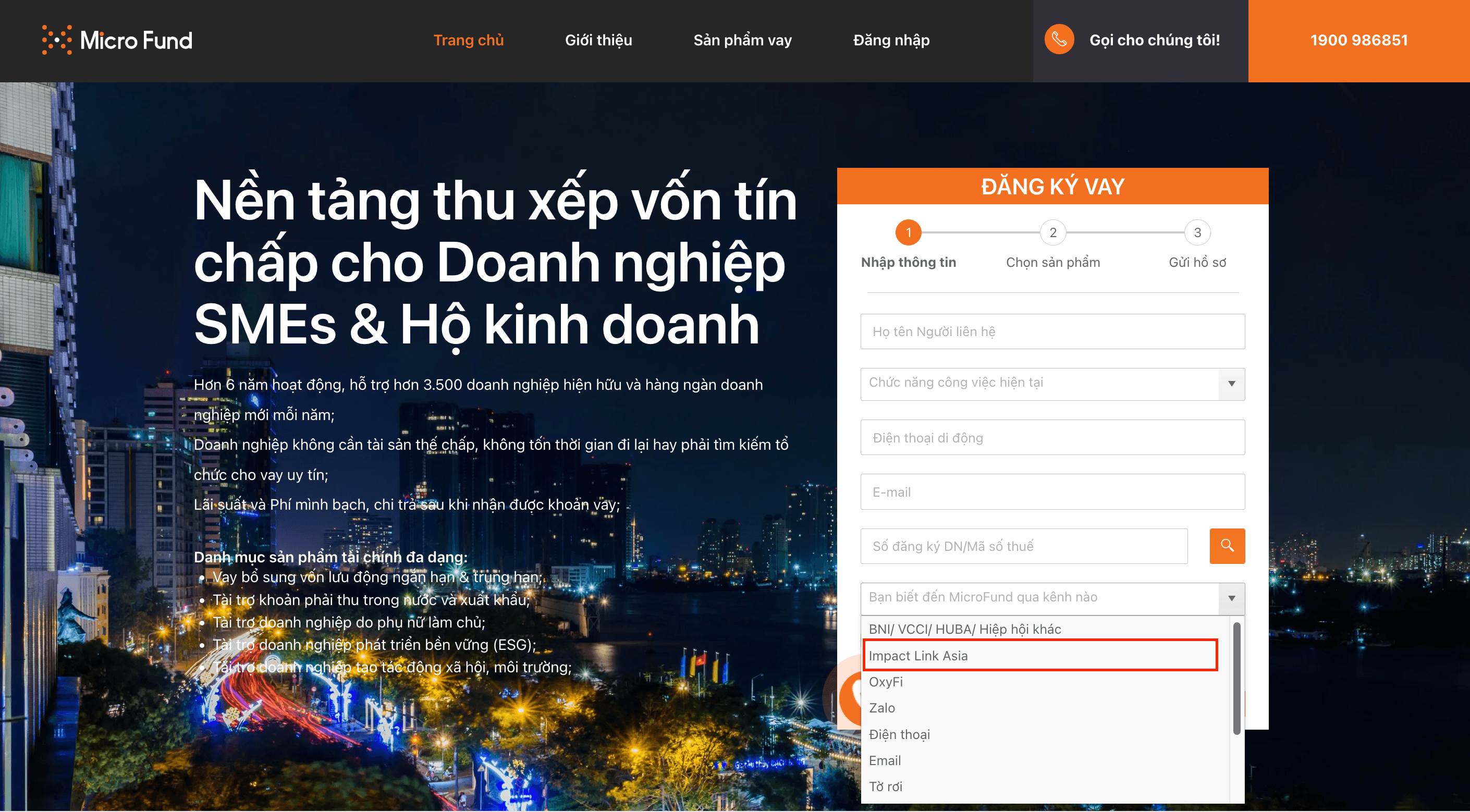

Step 01: The enterprise completes this INFORMATION FORM. This helps EcoChain gain a preliminary understanding of the enterprise’s financing needs and assess your eligibility for the program.

Step 02: Follow the instructions the information form to complete the second step on Micro Fund.

Once both steps are completed and the system successfully records the application on MicroFund, EcoChain will notify the enterprise via the email provided.

In-depth interview round: After the initial assessment, qualified SMEs will be invited to participate in an in-depth interview with EcoChain to determine their alignment with the criteria of banks and funders within EcoChain’s partner network.

Through the information gathered from the Initial Screening Round and the In-depth Interview Round, Impact Link and MicroFund will assess each SME’s impact score and credit score, thereby evaluating their creditworthiness, the positive social or environmental impact they create, and further determining their alignment with the criteria of banks and funders.

Once assessed, your application is sent to the Bank or Funder.

- They review your scores and the information provided.

- If you meet their requirements, you get approval to proceed.

The Bank or Funder decides the loan or grant terms.

- If your impact score is high, you receive preferred interest rates or possibly a grant.

- If your score is lower, you may still get funding, but at standard rates.

Who Should Apply?

EcoChain is specifically designed for impact-driven small and medium-sized enterprises (SMEs) in Vietnam. If you are a business leader who is deeply committed to creating a better future, this is for you. If you are an SME working in WASH (Water, Sanitation, and Hygiene), Agriculture, Environment, Food or Manufacturing and are interested in EcoChain, apply now via this INFORMATION FORM.

Funders, banks - partner with EcoChain to de-risk SME finance in Vietnam.

Funders can catalyze early-stage impact, while banks gain a proven pipeline of credit-ready, high-impact enterprises!